To do that welland in a means that keeps us healthy and balanced as a companywe have to maintain a sharp eye on our information as well as how our designs carry out over time. Our actuaries are knee-deep in the numbers everyday, doing the difficult insurance policy calculationscreating, checking, and also double-checking our actuarial tables.

Your price will change for as lengthy as you have insurance. We use the finest innovation and information offered every day to make both our insurance protections as well as costs the ideal in the sector, as well as we will certainly stop at absolutely nothing to ensure our prices are the most exact in the service.

Car insurance coverage premiums are frequently climbing in the United States. Below are some of the general aspects that have the a lot of influence on exactly how cars and truck insurance policy prices are computed: Miles logged are boosting According to AAA, Americans are spending even more time on the road.

As an example, the Cadillac Escalade has among the highest burglary loss averages of any kind of vehicle when traveling, and various other lorries with high comprehensive losses consist of the Dodge Opposition and the Infinity G37. Among the least-stolen vehicles is the Toyota Prius. Sports automobiles often tend to have greater losses, as well as several chauffeurs purchase them for the sole reason of driving them quickly. laws.

cheapest car insurance insurers low-cost auto insurance suvs

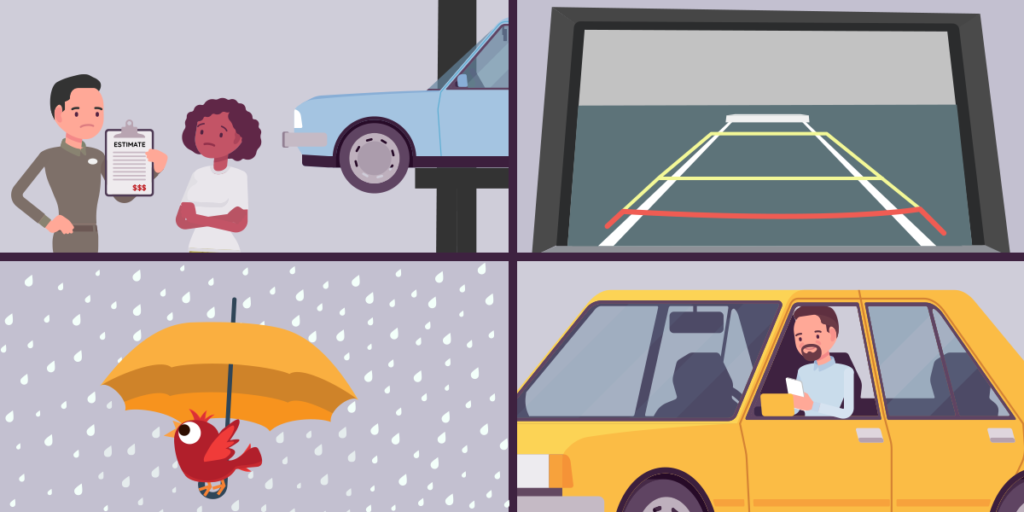

Clinical costs are installing Medical insurance premiums as well as medical prices have actually been rising at a consistent clip in the U.S. Those increases carry over into the costs automobile insurer sustain when motorists as well as travelers are hurt in a vehicle crash. Newer designs cost more to fix It's extra expensive to fix more recent cars and trucks that are full of a lot more sophisticated equipment as well as technology (cars).

Contact your Nationwide agent to make certain you have the most effective protection for your circumstance - cheaper.

The Only Guide to Average Auto Insurance Rates In Michigan Increase Slightly ...

Second, and a lot more notably, there are points you can do to off-set any kind of premium increase you get. At its most standard form, the premise of insurance policy is sharing threat and bearing expenses with others. Your specific circumstances or driving behaviors may not have changed, all of us are influenced by the following: Boosted populace, higher work prices, and also reduced gas costs led to automobiles taking a trip 653 billion miles on Washington's streets in 2015, an all-time high (car insurance).

Newer autos have progressed modern technology like blind place detection, ahead collision caution, as well as back-up cams that is more costly to fix. The United state established a new automobile sales record of virtually 17.

(Strategy & Price Water, Residence Coopers) Most importantly, drive very carefully. Observing web traffic regulations and speed up limitations and also avoiding relocating infractions and mishaps is the most effective method to minimize your insurance coverage expenses over time. There are additionally many immediate remedies to decreasing your car insurance costs: There is no one-sized-fits-all solution when it pertains to insurance.

These programs collect info about just how you drive, just how much you drive, and when you drive (car insurance). Insurer utilize this information to personalize your cars and truck insurance coverage price based upon your real driving, Your safe driving practices can assist you reduce auto insurance in some instances up to 30% of the costs.

Bonus: bundling your insurance policy with one company additionally simplifies payment, simplifies cases, as well as aids get rid of hazardous protection voids. As independent insurance agents, we represent the Pacific Northwest's best insurance coverage companies, including PEMCO, Safeco, Travelers, and also Progressive (insurance company).

Not a Mc, Clain Insurance customer yet? Visit this site to request an insurance coverage testimonial by among our agents, or call text our office at (425) 379-9200. business insurance.

The Ultimate Guide To How Much Does Insurance Go Up After An Accident?

Inevitably, the much safer a motorist you are, the much more you can Visit the website lower your insurance coverage premiums. A service provider may locate that they need to charge more as a result of higher claims paid in a state where expenses or lawsuits is higher. Busy cities might be a lot more susceptible to collisions or have a greater rate of lorry burglary, which might cause that more pricey premium.

Although, as brand-new drivers develop experience without collisions, rates do return down. Insurance coverage rates for all vehicle drivers mirror costs because of the deceitful techniques of the couple of. Examples include vehicle drivers that relocated however didn't report it, parents that do not include adolescent chauffeurs to their insurance policy intends to prevent expenses, organized mishaps and also chauffeurs who request greater price quotes at body shops.

Insurance carriers use tiers to place consumers based on their danger of being involved in an additional automobile accident. While not numerous people like to be placed, the sector utilizes the system to obtain an extra precise evaluation of your driving behaviors and also it sometimes assists protect against rates from increasing for a motorist just due to the fact that of one mishap.

Seeing your automobile insurance rates increase is undoubtedly irritating. Like groceries and also gas, "many view insurance coverage as an additional consumable," claimed Eng.

"The truth of insurance coverage is not if you have a case, yet what would certainly you like to see take place if you were to have an insurance claim," he stated. Although you may not like paying a higher price for your insurance, you'll be appreciative to have it if you ever need it.

It's common for insurance companies to increase auto insurance prices after you've been in a crash, sued because a tree came down on your lorry, or had a regrettable confrontation with a deer. However often rates can boost without warning. The insurer might elevate your prices for many factors, and some of them have absolutely nothing to do with your driving record or insurance claims background (car insurance).

See This Report about Will My Car Insurance Go Up If I'm Not At Fault For An Accident?

Car insurance assists pay for things like accident-related clinical expenses, property damage, and also claims. In general, there are six primary kinds of coverage for automobile insurance policy policies.

Comprehensive pays the fixing or replacement prices if your vehicle is damaged by a selection of incidents, including hail, quakes, cyclones, theft, criminal damage, and also extra. Not everybody has insurance policy, even though it's the law in many states. low-cost auto insurance. If a without insurance or underinsured driver hits you, this protection begins to aid cover the cost of repair work and also medical bills.

cheap insurance car insurance car insurance liability

cheap insurance car insurance car insurance liability

If you avoid optional insurance policy where you live, you may not be covered if the unexpected occurs. Even if you have a tidy driving document, the insurance company may still increase your car insurance policy prices, as well as there could be many factors why.

As an insurer's cost of working rises across the board, they might boost your premium to aid counter their costs. It's not unusual for insurance companies to raise vehicle insurance prices if there's been an uptick in severe weather condition occasions or the number of accidents in your area. Both raise the probability that the insurer will need to pay out a claim.

Insurance policy business utilize numerous different elements to figure out vehicle insurance policy prices, and also the requirements they utilize might vary from one insurer to another. While a rate boost probably isn't welcome information for anyone, numerous of the aspects insurance providers use to establish costs remain within your control. Vehicle drivers without accidents, speeding tickets, or other moving violations on their document stand for much less of a risk to insurance firms and also typically get reduced rates than people with a spotty driving document.

Insurance business think about more youthful as well as older drivers to be a higher risk, and their costs reflect that due to the fact that stats reveal they have a tendency to get in more accidents. If you live in a location where the insurance company is much more likely to pay out a case for one of these cases, your price will usually be higher.

Unknown Facts About Why Is My Car Insurance So High? - Ramseysolutions.com

vehicle insurance dui auto insurance cars

vehicle insurance dui auto insurance cars

Be sure to ask your insurance company about the price cuts they supply. If you do not place a great deal of miles on your automobile, you could be able to conserve money with a pay-per-mile strategy rather than a standard automobile insurance plan. Vehicle insurer provide a range of discount rates that can help in reducing your prices.

prices trucks low cost auto car insurance

prices trucks low cost auto car insurance

There are few points extra frustrating than opening your auto insurance renewal and also seeing that your costs have gone up. It's also worse if you have not made any type of claims, according to The Equilibrium (insurance company). Recognizing the reasons this takes place can really spare you from undesirable surprises as well as can save you cash.

Usual Factors for Cars And Truck Insurance to Increase, A number of variables can cause your auto insurance coverage costs to increase. Generally, these relate to your background either as a chauffeur or with the service provider, according to the Insurance Coverage Info Institute - cheap car. They include: Involvement in a crash.

Cancellation of connected plans. Let's look at these thoroughly. At-Fault Collisions, If you've been associated with an accident and you were at fault, your premiums might well increase, according to The Balance. affordable. Most insurer base your premium on just how long you've do without at-fault crashes. Making an insurance claim for an at-fault crash implies you need to begin again.

That's creating costs to increase overall. Rising Healthcare Expenses, Healthcare expenses get on the increase. While that might not seem straight associated, it costs your car insurance money to pay for physical therapy and clinical therapies from mishaps in which you're involved. Since this sets you back the insurer cash, costs rise.

The assumption on the part of your insurer is that by living where you do, you're at a greater danger of being associated with such an event. This is since insurance policy costs basically enter into a huge pot from which all claims are paid. They have to bill you enough premiums that they can cover all of their customers in a location. car.

Auto Insurance Rates Are Increasing In 2022. Here's How To ... Can Be Fun For Anyone

Despite this, more people are doing it everyday. Actually, the rate of uninsured vehicle drivers rose by almost a percentage point in between 2010 as well as 2015, from 12. 3% to 13%, according to data from the Insurance policy Research Study Council. This brings about enhanced insurance claims by those who do have insurance when they require repair work after a mishap with a without insurance driver, as well as higher premiums are an outcome.

If they alter their techniques as well as your file hasn't been upgraded given that the last time you renewed, your rates might unfairly climb. One means this can occur is when your insurance provider alters the concern of your debt score, according to Price estimate Wizard. They can award favored prices for high credit report ratings, though not every state permits this. cheaper.

This is due to the fact that a low credit report brings an association with a greater price of claims and also a greater price of false insurance claims. If your credit rating is reduced, it can adversely impact your insurance rates. If your credit rating has risen, this may not be mirrored in your newest insurance coverage rates.