Yet if you have a driving document that has a background of traffic offenses and also accidents you are taken into consideration a high-risk chauffeur. Because instance, the insurer or the insurance coverage agent will recommend you take a lower insurance deductible even with additional premiums (cheapest car insurance). If you select a program that awards secure driving like Nationwide's Vanishing Deductible, which permits you to shave $100 off of your insurance deductible for every year of secure driving.

Saving a couple of bucks in the short term could suggest you pay extra in the lengthy term.

When developing an allocate your car insurance, there are 2 key expenses that you have to bear in mind your regular monthly premiums/rates and also your deductibles. Bear in mind we are speaking about automobile insurance and not life insurance policy, where your deductibles are an annual repeating settlement. Function of a Vehicle Insurance Coverage Deductible, When it comes to getting auto insurance coverage, a deductible is paid when you sue for your automobile in order to have your auto insurance coverage cover the repair work.

cheaper cars auto insurance auto

cheaper cars auto insurance auto

Auto insurance deductibles function constantly with the different sorts of automobile insurance coverage you may buy for your auto. There are likewise some protection kinds (like obligation) that an insurance deductible might not relate to (cheapest car insurance). At the exact same time, you're likewise able to personalize your insurance deductible amount to much better suit your auto insurance coverage budget plan.

There are a couple of important things you need to know before deciding just how much you need to establish your auto insurance deductible amount for. We'll review what your deductibles can apply to as well as just how they can impact your car insurance coverage all at once (cheaper car insurance). Take into consideration all that follows your individual overview to automobile insurance deductibles.

Naturally, there's responsibility insurance coverage which most states require their vehicle drivers to carry in case they create one more vehicle driver physical harm or car damages. Automobile insurance coverage deductibles won't relate to harm that you caused to one more motorist. It does apply under an accident or comprehensive plan - vehicle insurance. Crash insurance coverage covers you in case an additional at-fault chauffeur causes you bodily or vehicle damage.

What Is A Deductible In Car Insurance? - J.d. Power for Beginners

These actually may be required in some states. Injury aids cover medical costs for you as well as other travelers in your auto at the time of the accident. Uninsured driver protection, as the name recommends, covers you should you be struck by a motorist without any automobile insurance coverage to cover the problems.

car automobile insurance credit

car automobile insurance credit

Vehicle Insurance Coverage Deductible Quantity, An automobile insurance policyholder is able to establish their deductible limitation when taking out a new policy. Chauffeurs can set their automobile deductibles anywhere between $100 to $2,500.

Deductibles Impact Just How Much You Pay For Car Insurance, This is just the cost of your deductibles. An additional number of main car insurance policy sets you back to keep in mind are your costs. The partnership in between your costs and deductibles is direct domino effect in the globe of automobile insurance coverage. A higher vehicle insurance deductible restriction can cause lower premiums, while a lower deductible limitation can enhance your month-to-month premiums as well as the general cost of auto insurance coverage.

Your regular monthly premium would be around $250, which is the average. Currently, let's state that you raise your deductible to $250. This would certainly trigger your cars and truck insurance rates to drop to $182. Likewise, a deductible limit of $500 would certainly cause reduced monthly automobile rates of $129. Chauffeurs with deductibles of $1000 may pay less than $100 a month.

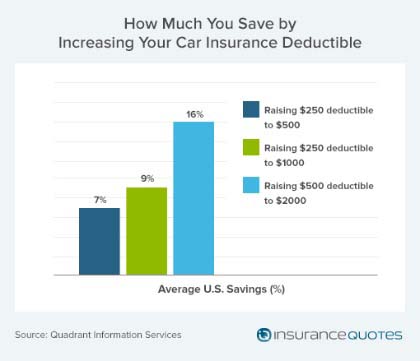

Like, upping your deductible from $1,000 to $2,000 might just conserve you around 6%, while $500 to $1,000 can save you as much as 40%. There are some deductibles that aren't worth it (insurance companies). When is a Car Insurance Policy Insurance Deductible Paid? What determines whether you'll need to pay a deductible is the circumstance of the auto damages and what automobile insurance strategy you utilize to cover it.

What does permit you to pay deductibles prior to the vehicle insurance policy company covers the repair service costs are: - Liability insurance coverage will not allow an insurance deductible for repair services to damages suffered in a mishap that was the mistake of one more motorist. Now, if you were at mistake for the accident as well as damages, after that damages to your vehicle would be covered by your collision policy, which enables deductible use. risks.

The Best Strategy To Use For What Is A Deductible? - Insurance Dictionary

After filing the vehicle insurance claim, you would be able to pay your deductible. - In Click here for info no-fault states, whoever caused the mishap to begin with isn't vital and calls for motorists to carry no-fault or personal security car insurance. This covers injuries as well as damage to your automobile. You pay the personal security insurance deductible when you file your vehicle case.

If your damage surpasses their very own automobile insurance policy protection restrictions, you might be able to pay a deductible in the direction of it. When Isn't an Auto Insurance Policy Deductible Paid?

Perhaps you do not desire the insurance deductible quantity deducted from your insurance coverage payment. If that's the instance, below are a number of ways you can stay clear of paying your deductible if unwanted: - As stressed throughout, if you are hit by one more motorist, then their obligation automobile insurance coverage would cover the prices of your repairs and also injuries (auto).

- In a circumstance where you have to pay your deductible but do not wish to, you might have the ability to exercise something with the auto mechanic. They would certainly bill your vehicle insurance provider sans the insurance deductible quantity while you set up a layaway plan - cheapest car. The mechanic might hold your vehicle until the insurance deductible is paid.

- While it varies with automobile insurance coverage firms, you may be able to forgo your deductible when you sue. The mechanic or car store will charge your insurance firm without the deductible. This is much more typical with lower deductibles like $250 and also $500. A $1,000 insurance deductible would certainly be virtually impossible for a car shop or vehicle insurer to waive.

Rather of changing them, they fix them, provided that the damages isn't also severe. You won't need to pay an insurance deductible to your car insurance provider. laws. Finest Method For Establishing Your Insurance deductible, When deciding on what your auto insurance deductible quantity must be if you ever require to sue, there are several variables to think of.

Auto Insurance Deductibles: How Do They Work? Fundamentals Explained

At the exact same time, it aids to assume regarding what your personal budget allows. Right here's what you must take into consideration concerning your cars and truck insurance coverage when setting your deductible restriction: - A vehicle insurance deductible is paid by the insurance holder expense. Beginning by asking on your own if you have the ability to pay $500 or $1,000 at any type of provided minute because accidents do occur.

- With your insurance deductible, consider just how much your car insurance provider will payment after you submit your case. Would a higher regular monthly vehicle costs deserve the lower insurance deductible, or vice versa? - If an additional chauffeur (with cars and truck insurance policy) is in charge of any kind of damages, after that you don't need to pay the insurance deductible considering that it's the various other chauffeur's insurance coverage covering it.

cheaper car insurance cars car low cost auto

cheaper car insurance cars car low cost auto

The regular monthly costs may be a little much, but that suggests that the deductible is low. A lot of drivers of leased autos pick reduced deductibles that use even more coverage.

They're able to set their crash insurance deductible reduced or higher than their comprehensive deductible. Disappearing Deductible Discount, A disappearing deductible is an insurance coverage option where the insurance holders pay a fee for reduced deductibles whenever a claim is submitted.

At the very same time, it's directly proportional to your month-to-month rates. There are also a pair of ways you can save money on those prices by searching or bundling other kinds of insurance coverage with a certain firm. While it is a great concept to lower your deductible if you desire more insurance coverage, it's not the very best strategy to increase them if you want your vehicle protection to be less costly - cheap car insurance.

Deductibles might be a standard component of insurance policies, yet that doesn't indicate every person understands exactly how they work. Some vehicle drivers aren't conscious that your deductible can really affect the quantity you pay for car insurance policy.

What Does Who Pays For My Deductible After A Car Accident? - The ... Do?

Deductibles can put on the coverages you have for damages to your car, like thorough and accident. You might additionally have an insurance deductible for medical settlements or accident security. Put one more method, "it's the quantity of a fixing bill you want to pay when you sue," claims Consumer Matters.

Usually, the insured is accountable for covering the repair service sets you back up to the insurance deductible; the insurance firm covers the rest. What deductible should I choose for car Insurance coverage?

What are you most comfortable with? "Keep in mind that in the occasion of loss you'll be accountable for the deductible, so make sure you fit with the amount," says the Insurance coverage Info Institute If you determine to increase your deductible, do your ideal to keep at least that amount of cash in cost savings each month (liability).

Your vehicle insurance deductible is the collection quantity of money you need to pay towards cars and truck insurance repair work. The staying equilibrium is paid by your insurance policy company. For instance, you're in a mishap that triggers $6,000 worth of damage to your automobile as well as your insurance deductible is $500. You pay $500 and also your insurance pays $5,500 toward the repair work.

Deductibles typically vary anywhere from $200-$2000. The most common insurance deductible amount is $500. Maintain the below ratio in mind when choosing your deductible amount: Lower deductible = Higher vehicle insurance policy rate as well as reduced out of pocket expenses, Greater insurance deductible = Lower auto insurance price as well as higher out of pocket prices.

As soon as your claim is approved, your insurer provides a payout. Your insurance provider then deducts your insurance deductible amount from your claim's payout quantity. As an example, allow's claim your claim is authorized for $2,500 and also your insurance deductible is $500. Your insurance company writes you a look for $2,000. You do not have to worry concerning sending your insurance provider a check.

Automobile Insurance Guide for Dummies

Some insurance firm's may ask you to pay your insurance deductible first. When do not you have to pay your insurance deductible? You don't need to worry concerning paying a deductible in the adhering to situations:- When another driver strikes you as well as it's considered their mistake, their insurance policy is called for to pay your problems. vehicle insurance. With accident protection, you can choose to undergo your own insurance firm.

- In short, there is no deductible in a liability case. Up to your plan's limitation, you pay nothing in the direction of any type of problems or injuries you created an additional person. Your insurance policy pays for the obligation case. - A few states use the alternative of choosing a $0 insurance deductible on extensive insurance policy.

vehicle affordable auto insurance vehicle insurance companies

vehicle affordable auto insurance vehicle insurance companies

Some insurer (like Progressive), offer this in situations where glass repair service is possible. It is essential to choose the ideal auto insurance deductible See to it you pick the ideal auto insurance coverage deductible for your requirements - credit score. Do not neglect to consider your out-of-pocket capacities, your car's worth, as well as the sort of insurance coverage.

If you've already experienced a claim, you have actually most likely discovered just how your insurance deductible jobs very first hand. For those that have not, it can cause confusion about just what a deductible is and who pays for it - car insured. What a deductible is An insurance deductible is the amount of money you (the called insured on the plan) pays of pocket for the price of damages prior to the insurance policy business pays.